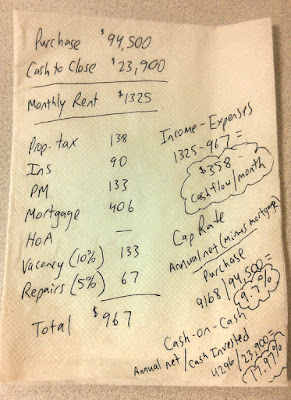

Once you find a potential rental property to invest you must run the numbers and make sure it fits your investment strategy, in other words how do you check if the property will give you a positive cash flow and what will the return in your investment be? Here is a simplified version on how to run the numbers:

1- Monthly income: Income generated by the current/potential Rent, coin laundry, parking spots, storage rental (if applicable) or any other income produced by the property.

2- Monthly expenses: Property tax, insurance, property management (if applicable), condo/strata fee (if applicable), vacancy (3%) and repairs (10%).

3- Net Operating Income (NOI): Subtract the monthly expenses from the monthly income, this is the income the property is producing before debt/mortgage payments.

Monthly income - Monthly expenses= Net Operating Income

4- Cash flow: This is the income in your pocket before taxes. Subtract the debt/mortgage payments from the NOI to determine if the property produces a positive or negative cash flow. The cash flow should be a positive number otherwise move on to the next property.

5- Cap Rate: It compares the ROI (return on investment) to the purchase price. It’s the ratio between the NOI produced by the asset and its capital costs (current market value or original price paid to buy the asset). The higher the numbers, better the returns. I usually look for cap rates above 6% (depending on the market, city, age of the building etc). The formula is:

Net Operating Income/Purchase Price= Cap Rate

6- Cash-on-Cash Return: It’s a calculation used to verify the return in your total cash invested (down-payment, closing costs and repairs). Any percentage above 6% is considered a good return since banks, GICs, mutual funds only pays between .5 to 3% interest in your money. The formula used is:

Net Annual Income/Total Cash Invested= Cash-on-Cash Return

By following these basic steps, it should help you determine if the potential property is worth moving forward or passing it.

|

| biggerpockets.com |

If you are looking for a rental property to invest feel free to contact me and I will be happy to assist you in every step of the process

Best regards,

Arthur Zaragoza

This comment has been removed by a blog administrator.

ReplyDeleteHello dear guys,

ReplyDeleteThe area and neighborhood is the most important thing to consider when building a laundromat business. When you build a laundromat service or obtaining a coin-operated laundry service, ask the owner why they have decided to sell. Be persistent with your inquiries.Read more at-:24 hour Toronto coin laundromat

Thanks and welcome

Sharmin

Hi there,

ReplyDeleteThere are several reasons for this sudden increase in business at coin laundromats. First, when the season changes from winter to spring, people will put away their winter clothing and start wearing spring apparel.See more at- Toronto laundromat services

Thanks and welcome

Sharmin

Hello dear guys,

ReplyDeleteThe area and neighborhood is the most important thing to consider when building a laundromat business.The best laundromats in Toronto are as hard to find as a missing sock. There are thousands of them in the city, and most are destined to ruin your clothes sooner or later (probably sooner). But laundromats force us into the uneasy choice of convenience over quality, so we take our chances with unreliable washers and unclean dryers simply because we can walk over to the place in our pyjamas.Read more at-:North York 24 hour coin laundromats

Thanks and welcome

Sharmin